|

Cost Accounting - intermediate level

Cost Accounting intermediate level includes 5 main topics: Cost Accounting intermediate level includes 5 main topics:

1、Cost accounting term and relationship;

2、Labor cost;

3、Cost calculation method;

4、Budget control;

5、Accounting system;

In the 1st topic, we should understand the relation among cost accounting、financial accounting and managerial accounting. We should know cost center, according to cost performance classify cost as below: variable cost, mixed cost, stepped cost and fixed cost.

In the topic of labor cost, we need: In the topic of labor cost, we need:

1、Confirm an organization’s main cost due to hire employees;

2、Describe various ways of paying personal remuneration and proceed accounting treatment;

3、Accounting treatment for overtime pay, shift allowance and shut down;

4、Base on time (human working hours、machine working hours、processing hours) and cost (direct material cost、direct human cost and initial cost) to calculate and apply production overhead rate.

5、Understand the necessity of sharing administrative expenses、selling expenses and distribution expenses, and establish appropriate rate, know the factors included and flexibility needed.

In the method of cost calculation, we should differentiate work、batch、contract and processing cost. Then the projects which we should understand is: break-even point calculation, unit product’s fixed cost、unit selling’s fixed cost. Although these are not the exam content in cost accounting 2, it’s very important content in course level 3.

In the part of budget control, we will understand area selling budget、product selling budget and salesperson selling budget. We must also fully understand the importance of material usage budget, must familiar with this kind of accounting tool.

We must prepare also: We must prepare also:

1、machine usage or processing usage budget;

2、direct labor budget;

3、manufacturing expenses budget.

In the topic of accounting system, we will discuss the whole accounting system’s property and function.

Please pay special attention to below: Please pay special attention to below:

1、accounts control;

2、material stock;

3、semi-finished products;

4、finished products;

5、production overhead.

Meanwhile, we should be able to provide necessary ledger.

Cost accounting 2 introduce the knowledge of cost accounting, lay foundation for level 3. This is a very important course in accounting area, it makes us understand company property, and allocate the cost in the most suitable way.

-------------------------------------------------------------------------

Cost Accounting - advanced level

Through the course of cost accounting advanced level, you will learn: Through the course of cost accounting advanced level, you will learn:

1、cost operation

2、cost department

3、product producing

4、method of product service

5、principle and skill

Effective use resources, include through difference analysis to control decision’s relevant cost.

Calculation of material, labor indirect cost and working procedure;

Calculation of raw material cost amount、rate of return、usage of raw material、standard working hours、sharing of indirect cost.

Stock control:

Calculate and use economic order batch.

Method of marginal cost:

Differentiate marginal cost and full cost by principle and essence, especially in the calculation of inventory valuation and profit.

Budget control:

Cash budget、limit factors、fixed budget and elastic budget

Standard cost and differences:

Establishment of standard cost. Type of standard cost. Difference analysis of production cost (include mixed differences)、calculation of relevant control rate.

Weekend class of cost accounting intermediate level & advanced level

Certificate: < cost accounting intermediate level、advanced level> international vocational qualification certificate

Certified institution: London Chamber of Commerce and Industry Examinations Board (LCCI) and China’s ministry of education overseas test center

Course background:

LCCI is the abbreviation of London Chamber of Commerce and Industry Examinations Board, it’s one of the international most authoritative vocational technique training and vocational qualification appraisal organization. Founded in 1890, it has more than 5000 examination centers at more than 90 countries in the world, more than millions’ candidates take part in the exam every year. The certificate and diploma was universally acknowledged by these countries, especially in the Commonwealth nations and Southeast Asian nations, the certificate and diploma enjoyed the reputation of “international employment green card.”

Course content: Please see the details as “above course instruction”

Adaptive object: college or above all kinds of fresh and past graduate student or other people who want to develop in finance、 audit 、business area;

Teaching material: (English edition) price: 110 Yuan/Renminbi/one book (bound volume)

Course time: 48 class hour/intermediate level; 54 class hour/advanced level

Class cost: 1200 Yuan/people/intermediate level; 1500 Yuan/people/advanced level

Teaching time: 19th, Mar.2016 (Saturday) am 9:00--12:00

Online registration: Please fill subject directly

Course advantage:

1、Course content aim at business、finance、audit、producing area enterprise’s practical working needed english knowledge;

2、Course contains plenty of business and finance area’s listen,speak,read,write ability and international universal industry technique training;

Teachers features:

1、Over five years’ financial area experiences, proficient English, rich position experiences;

2、Good at heuristic education, case teaching is simple but profound, provide lot of simulation exercises for student to practice;

Job position: foreign-related enterprise、foreign capital bank financial accounting、auditor、sales、 production management.

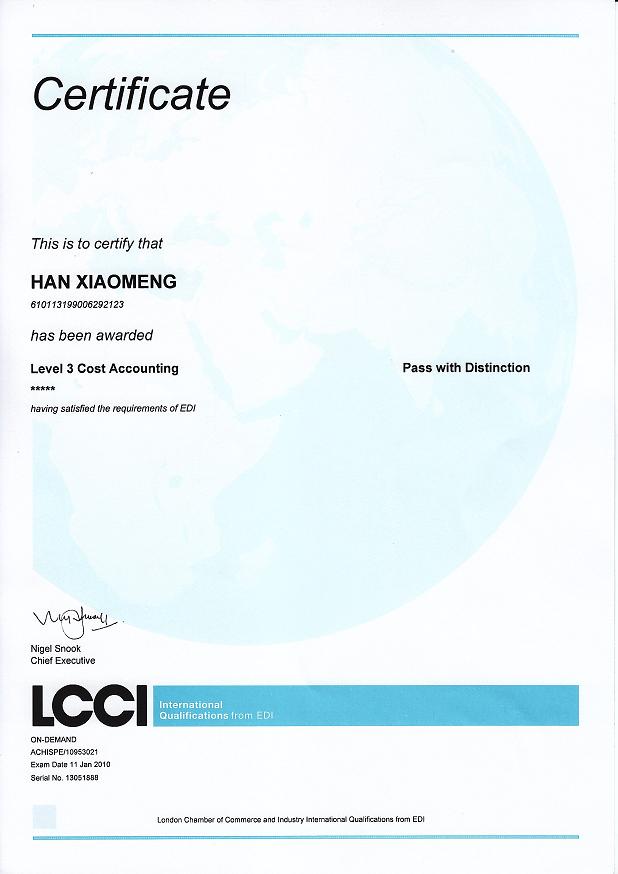

British LCCI cost accounting senior international certificate sample

|

![]()